BCG matrix

Definition

What is the BCG matrix?

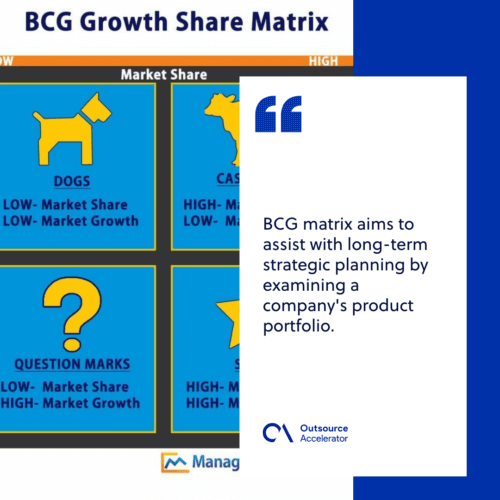

Established by the Boston Consulting Group, from which the term originated, the BCG matrix is a portfolio management framework that aids companies in assessing the value of their offerings and which ones should take priority. BCG matrix was originally called the growth-share matrix.

The matrix aims to assist with long-term strategic planning by examining a company’s product portfolio. It also determines where to invest, terminate, or develop items.

The BCG matrix offers four types of scenarios in terms of the company’s market share, cash flow generation, and industry growth rate. Stars, cash cows, question marks, and dogs are the four quadrants or situations in the BCG matrix.

BCG matrix quadrants

Analyzing market growth should objectively establish your competitive edge over your competitors and help you plan for years of development.

The four quadrants of products in the BCG matrix are each categorized as low or high-improvement compared to the proportional market share and market growth.

Stars

Stars are the business lines or products that have the leading market share and make the most income. Stars are often used to describe monopolies and first-to-market items. On the other hand, they consume a lot of money due to their rapid growth,

Companies should invest in stars, according to a critical premise of the BCG growth strategy. They are said to have great future potential.

Cash cows

A cash cow is a leading company that makes more money than it spends. Cash cows are businesses or goods with a significant market share but limited development potential.

Cash cows provide the money required to convert a question mark into a competitive market, supporting the company’s administrative needs. Cash cows are also recommended for “milking” cash to be reinvested.

Pets/dogs

Pets, more commonly called dogs, are those with low market share and low growth. They have a risk of being cash traps, with businesses investing and receiving little in return.As such, the best course of action for dogs is to either sell, liquidate, or reposition them.

Question marks

Those in the question mark quadrant show a lot of growth in the market yet don’t maintain a significant share.

On one hand, question marks may waste money in the end. On the other, these business units are fast-growing and have the potential to become stars in a high-growth sector.

If a product has growth potential, companies should invest in question marks; if it does not, they should sell.

The drawbacks of the BCG matrix

The most obvious disadvantage of this strategy is that it solely considers market share and cash flows, ignoring other business elements that are equally vital for success.

For instance, f the corporation chooses cash cows or stars but the top management or the staff are inefficient, the company will lose profits.

Selecting stars and cash cows, on the other hand, does not ensure that the company will only produce profits.

Independent

Independent