Outsource Accelerator’s Employee Cost Calculator

Do you ever find yourself wondering how much it really costs to hire an employee?

Labor costs can be a significant expenditure for businesses, and understanding them is crucial for effective budgeting and decision-making.

To help businesses calculate their labor costs accurately, Outsource Accelerator (OA) provides an Employee Cost Calculator or Team Builder that takes into account various factors.

What is an employee cost calculator?

An employee cost calculator is a powerful tool that helps businesses estimate the overall cost of hiring an employee. It takes into account various factors and provides a comprehensive breakdown of the expenses involved.

Using an employee cost calculator allows organizations to make informed decisions regarding their hiring budgets and explore cost-saving alternatives.

Labor or employee cost calculation

A common labor cost calculation works like this:

1. Calculate gross pay

If employees work full-time (40 hours per week), multiply by the average number of weeks in a year (40 x 52 = 2,080 hours).

Example: If the pay rate is $10 per hour, the gross pay is $20,800 per year.

2. Estimate net hours worked

Consider absences (ex., 15 days a year, 8 hours per day). Subtract hours not worked from gross hours to get net hours worked (ex., 2,080 – 120 = 1,960).

3. Sum additional annual costs

Include taxes, insurance, benefits, overtime, and supplies.

4. Compute annual payroll labor cost

Add gross pay to other annual costs. (ex., $20,800 + $3,900 = $24,700).

5. Estimate actual hourly labor cost

Divide annual payroll labor cost by net hours worked (ex., $24,700 / 1,960 = $12.60).

6. Approximate labor cost percentage

Calculate the percentage of labor cost relative to total revenue.

Example: If total revenue is $80,000, the labor cost percentage is 30.9%.

Labor costs and other factors to consider

Before we delve into the specifics of Outsource Accelerator’s Outsource Calculator, it’s essential to understand labor costs.

Labor cost or employee cost refers to the total amount a company spends on an employee. These costs include the following:

Salary and wages

Now, here’s the lowdown on salary versus wages. Salary is the fixed amount an employee gets, no matter how many hours they work. Wages, on the other hand, change based on the hours one puts in.

Don’t forget about bonuses, commissions, and overtime pay – those can add up too.

For the sake of simplicity and specificity, let’s focus on calculating employee costs if you hire workers in the Philippines.

Organizations that choose offshore work to Filipino workers usually offer a minimum of USD 500 or PHP 25,000 monthly salary.

Benefits and perks

Let’s talk about the extra stuff that comes with having employees — the perks and benefits.

To figure out how much these benefits cost on average for each employee, divide the total cost of all the benefits by the total number of employees.

In the Philippines, where many opt to delegate various work, you can expect the following unique benefits and perks in your Filipino workers’ compensation package:

- PhilHealth and HMO. PhilHealth and HMO contributions are included, so health insurance and medical expense coverage are given to Filipino workers.

- Social Security System (SSS). SSS provides social insurance, including sickness, maternity, retirement, and other benefits.

- Pag-IBIG Fund. PAG-IBIG offers housing loans, short-term loans, and savings programs for employees.

- 13th-month pay. 13th-month pay is the additional month’s salary given to workers in the Philippines during the Christmas season.

- Holiday pay. It refers to the additional compensation for employees working on regular holidays.

- Night shift differential. It is the extra pay for employees working during the night. This is especially relevant when you have an offshore team working in a different time zone.

Payroll taxes

When you’re running a business, it’s a given you’ve got to handle payroll taxes. It’s your responsibility as an employer to pay these taxes on behalf of your team.

If you have Filipino employees, you can get some help with accurate tax calculations from the Bureau of Internal Revenue or team up with payroll specialists.

Other factors that go into employee cost

Several factors can influence labor costs. Here are some important ones to take note of:

- Experience. The more experienced an employee is, the higher their salary expectations.

- Location. Offshore staff, especially in countries like the Philippines, often come at a more affordable price point compared to onshore options.

- Niche. Niche-specific roles require highly specialized skills, making it more challenging to find suitable candidates. Hiring for such positions might incur higher labor costs due to increased demand in the job market.

- Demand. The demand for certain roles can affect labor costs. For example, if there is a shortage of web developers, companies may need to offer higher salaries to attract and retain top talent.

Considering these factors, it becomes clear that accurately calculating the cost of labor can be quite complex. That is where an employee cost calculator comes in handy.

Features of Outsource Accelerator’s employee cost calculator

When utilizing an employee cost calculator, it is crucial to look for specific features that enhance its effectiveness.

Outsource Accelerator’s Team Builder, for instance, offers the following features:

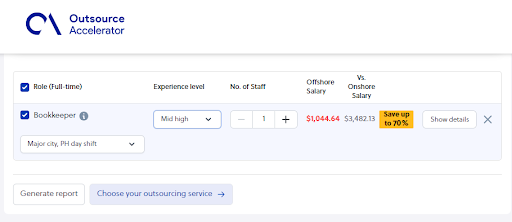

Salary estimator

This feature provides a salary estimation based on the employee’s experience, job role, and location. It ensures businesses have accurate data to work with when calculating labor costs.

Let’s say you’re looking for a bookkeeper with a mid-high experience level. OA’s Employee Cost Calculator lets you see the role’s estimated offshore and onshore salary.

The tool also factors in if the company is filling in for a full-time, part-time, or freelance employee. Plus, it considers the location of the candidate and the company’s preferred work shift.

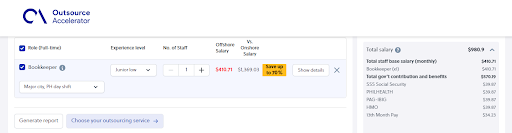

Benefits and deductions

A good labor cost calculator factors in benefits and deductions, such as health insurance, retirement plans, and payroll taxes. This ensures that the final cost estimate includes all relevant expenses.

Let’s continue using hiring a full-time bookkeeper as an example.

OA’s Team Builder lets you see the breakdown of benefits and deductions normally included in a Filipino employee’s payslip.

The breakdown on the right side shows the base-level estimation of the government contributions and benefits included in your employee’s package.

Currency conversion

For companies outsourcing to foreign locations, it is essential to have a currency conversion feature. This should take into account exchange rates and potential fluctuations.

OA’s Employee Cost Calculator has a currency conversion feature and the option to see the estimated cost for the role per month or year.

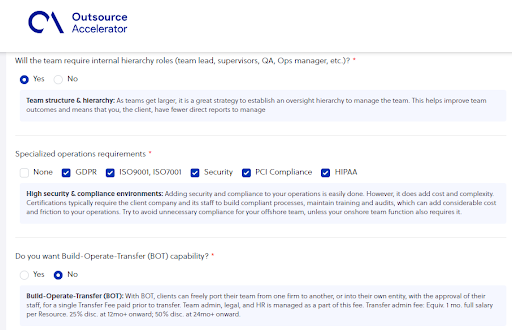

Customization options

A flexible labor cost calculator allows organizations to input specific variables unique to their business.

Outsource Accelerator’s calculator asks you specific questions, so you have a more accurate idea of the labor cost estimation.

Some of the important questions and criteria you can expect from OA’s comprehensive tool are:

- Where will your staff be working from?

- City selection for office location

- Hardware specifications

- Team size

- Project growth of the team

- Who will manage the staff and operations?

- Specialized operations requirements

- Do you want Build-Operate-Transfer (BOT) capability?

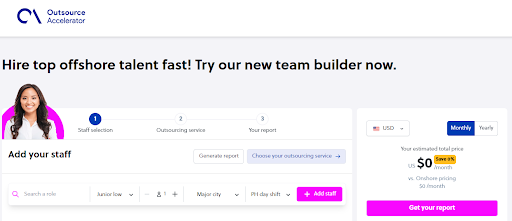

How to use Outsource Accelerator’s Employee Cost Calculator

Using Outsource Accelerator’s Employee Cost Calculator is straightforward. Here’s a step-by-step guide:

1. Visit the Outsource Accelerator website and navigate to the Team Builder page.

2. Begin with the staff selection and search for the role you’re looking to fill. In this case, we’ll try to find one full-time bookkeeper in a major Philippine city who can work US day shifts.

3. Review the results, which will provide an estimate of the total labor costs.

4. OA’s Team Builder aims to streamline the employee cost calculation and hiring process. So you can then proceed to answer various questions about the specific outsourcing service you want.

5. After you’ve indicated all the things you require for the role or team, a report will be generated that details the approximate labor cost.

6. Download the full, comprehensive report once you’ve registered with Outsource Accelerator’s services.

Calculate the cost of an employee with Outsource Accelerator

Ultimately, labor costs play a significant role in a company’s financial planning. Understanding the factors that influence labor costs, such as experience, location, niche, and demand, is crucial.

By utilizing Outsource Accelerator’s Employee Cost Calculator, businesses can accurately estimate the true cost of hiring an employee.

OA Team Builder’s valuable features, such as salary estimation, benefits consideration, currency conversion, and customization options, further enhance its effectiveness.

With an employee cost calculator, businesses can make informed decisions about their hiring budgets and explore cost-saving outsourcing options.

Take advantage of this valuable tool to maximize your business’s efficiency and profitability!

Independent

Independent